Auto Insurance in and around Blytheville

Looking for great auto insurance around the Blytheville area?

Take a drive, safely

Would you like to create a personalized auto quote?

You've Got Places To Be. Let Us Help!

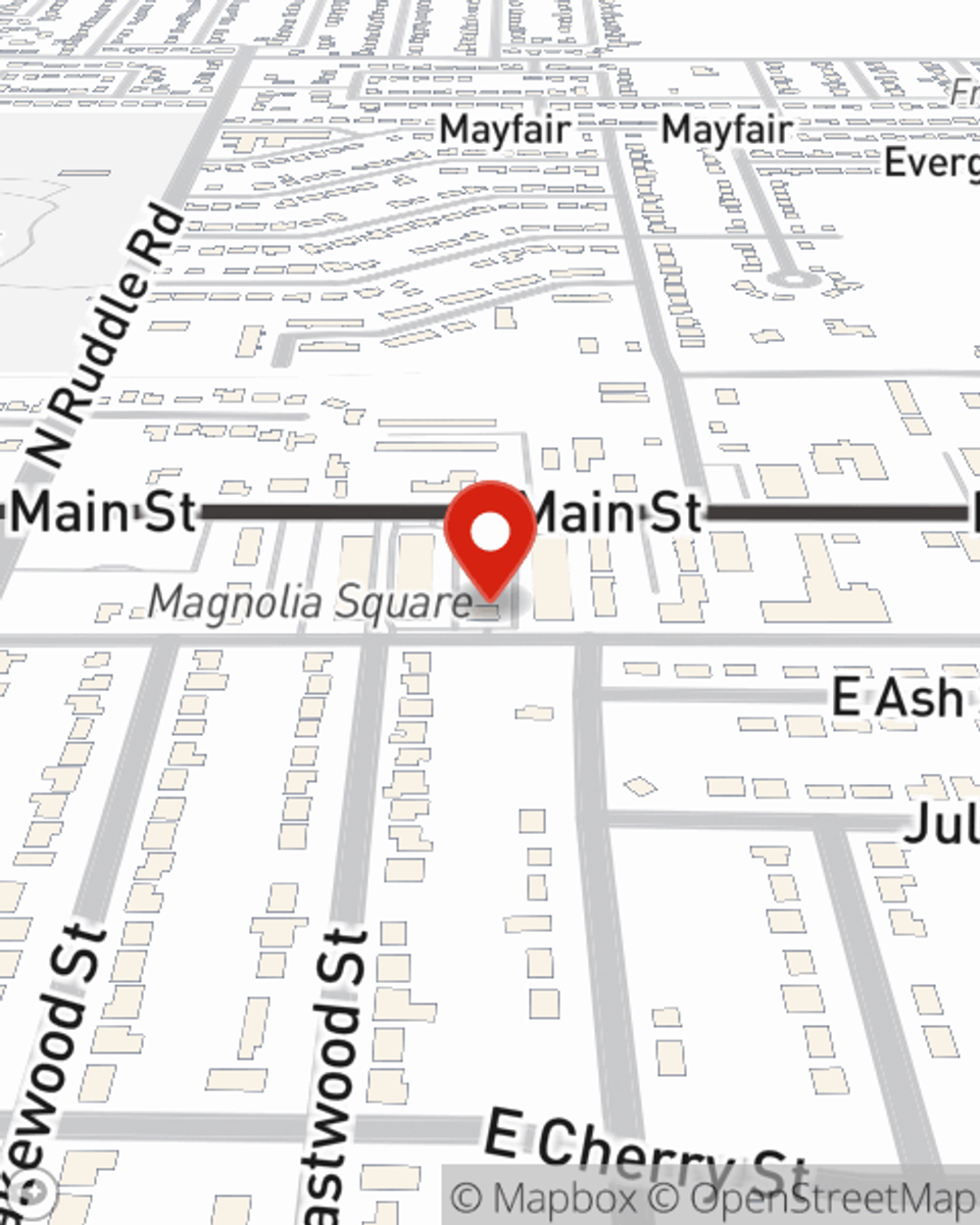

Why choose Seth Holifield as your State Farm auto insurance representative? You need an agent who is not only a professional in the field, but is also a caring associate. With State Farm, Blytheville drivers can enjoy a protection plan aligned with their specific needs, all backed by the State Farm name.

Looking for great auto insurance around the Blytheville area?

Take a drive, safely

Navigate The Road Ahead With State Farm

With State Farm, you won’t have to sort it out alone. Your State Farm Agent Seth Holifield can help you understand your coverage options. You'll get the excellent auto insurance coverage you need.

This can include coverage for a variety of situations and vehicles, too, like sports cars, antique or classic cars or teen driver coverage. And the benefits of State Farm don't stop there! When mishaps occur, you can be sure to receive personalized considerate care from State Farm agent Seth Holifield. Stop by Seth Holifield's office today!

Have More Questions About Auto Insurance?

Call Seth at (870) 762-1112 or visit our FAQ page.

Simple Insights®

Boating safety tips

Boating safety tips

Before you set sail and venture into the open waters, learn the essentials of boat safety.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Seth Holifield

State Farm® Insurance AgentSimple Insights®

Boating safety tips

Boating safety tips

Before you set sail and venture into the open waters, learn the essentials of boat safety.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.